Capital Advisory

Sourcing capital for qualified sponsors of residential & commercial real estate developments

Schedule a Call

What can our relationships do for you?

We are constantly cultivating relationships with debt and equity sources of capital all over the world. Our database of key contacts within these firms can get your project financed in almost any situation.

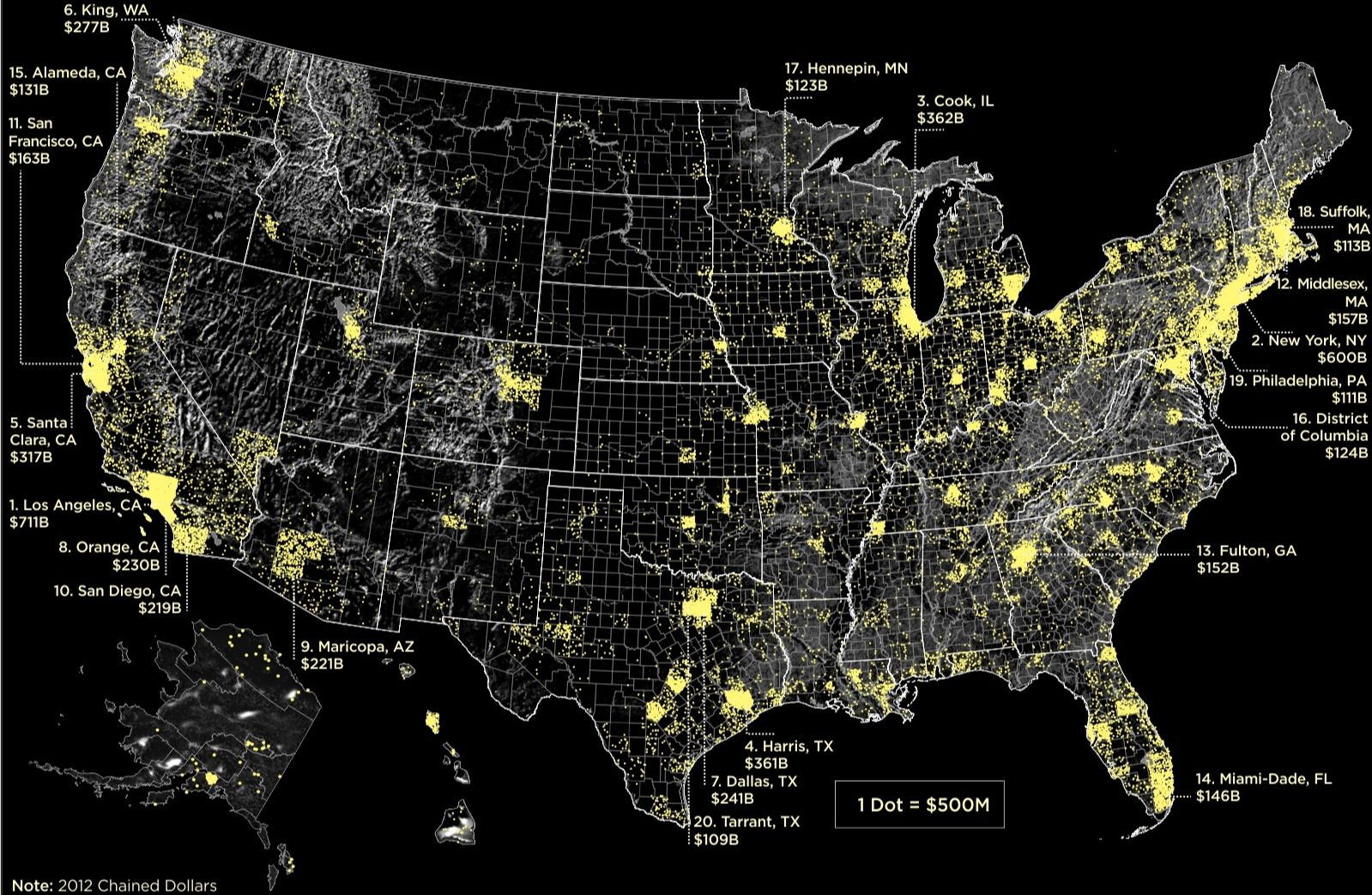

We help sponsors with deals across the country

-Major metropolitan areas

-High barrier to entry markets

-Supply / demand imbalances

-Population growth centers

We help sponsors with a variety of deal types

-Residential Fix & Flip

-Residential New Construction

-Multifamily Value Add

-Multifamily Entitlements

-Multifamily Construction

-Commercial Developments

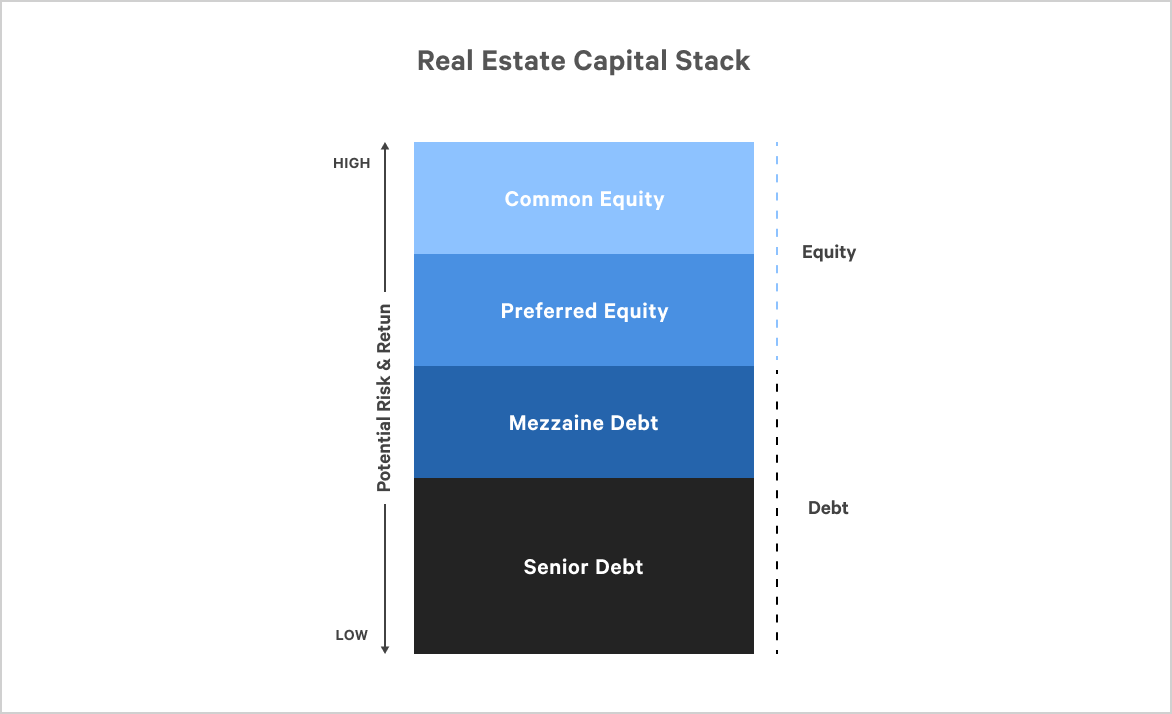

We help sponsors with the whole capital stack

-Joint Venture (JV) Partner Equity

-Co-General Partner (Co-GP) Equity

-Limited Partner (LP) Equity

-Preferred Equity

-Mezzanine Debt

-Senior Debt

Meet Your Capital Advisor

Chris Porto is the founder of Smart Growth Capital Advisors. After a decade as a real estate developer, Chris realized the lack of service being provided to development groups of all shapes and sizes to get access to the necessary capital to build their projects. Prior to entering real estate, he raised $100s of Millions of private equity for solar energy development projects with SunPower and advised Fortune 500 companies on their sustainability strategy with Deloitte Consulting. He obtained a bachelor's degree in Finance from Virginia Tech with minors in global business and leadership.

Debt

We seek to place senior debt with qualified sponsors / borrowers for their residential & commercial real estate development projects

Types of Senior Debt:

- Acquisition Loan

- Construction Loan

- Renovation Loan

- Bridge Loan

- Permanent Loan

Sources of Senior Debt:

- Community Banks

- Regional Banks

- Credit Unions

- Debt Funds

- Life Companies

- Private Credit

- Federal Agencies

Equity

We seek to connect private equity investors with qualified sponsors / partners for their residential & commercial real estate development projects

Types of Equity Investments:

- JV Equity

- Co-GP Equity

- LP Equity

Sources of Equity Investments:

- High Net Worth Individuals

- Family Offices (Single & Multi)

- Registered Investment Advisors (RIAs)

- Private Equity Funds

- Pension Funds

- Endowment Funds

- Sovereign Wealth Funds

Gap Financing

We seek to find creative solutions to fill the gap in the capital stack for sponsors / borrowers to executive on their residential & commercial real estate development projects

Types of Gap Financing:

- Mezzanine Debt

- Preferred Equity

- Property Assessed Clean Energy (PACE)

Looking to raise capital for your project?

Personalized Guidance

Let's schedule a call to discuss your project. We'll determine if it's the right fit for us to help raise the capital you need. We maintain relationships with private equity and debt providers across the country that could take your efforts to the next level.